Ok, so unless you have been in a hole somewhere, I am going to bet that you already know that we have a new tax situation here in the good ol’ United States. President Trump signed that thing called the Tax Cuts and Jobs Act into law on December 22, 2017. As people who own laundry equipment, that new tax law can be a pretty sweet deal. I am about to fill you in, so pay attention.

Put this in your head before dive into all this tax law rocket surgery: THERE HAS NEVER BEEN A BETTER TIME TO BUY LAUNDRY EQUIPMENT FROM A TAX SAVINGS STANDPOINT!

First of all, let’s talk about bonus depreciation and what that b-school nonsense word actually means. Bonus depreciation just fancy jargon for the idea that a business can immediately deduct a big part of the purchase price of a big asset right away. That leads to paper losses, and lower tax liability. Big write-off, lower taxes. Simple, right?

Well, until the Tax Cuts and Jobs Act (let’s call it the WHAMMO TAX ACT, because I am tired of writing that totally boring and unimaginative name the old folks in Washington decided to name it,) you could take only 50% bonus depreciation in the first year after buying your equipment. Cool and the gang, right? You buy $100K worth of equipment in April of 2017, you could have written off $50K worth of the purchase price through the Monopoly-Money expense called Depreciation. That means, the old folks in Washington take it for granted that your business earned $50K less.

Boom goes the dynamite, along comes the WHAMMO TAX ACT of 2017. Now, YOU, my laundry equipment buying friend, can bonus depreciate (yeah, I just verbed that word. Mad props to me.) all $100K of that purchase. So that $100K comes off your earnings, making it look like you made less money to the old guys in Washington and lowing your tax bill. NICE. You want to know something else? If you bought that stuff after September 27, 2017, you can deduct the whole amount. Why they picked that date, no one will ever know. Ask an old fart in Washington. Maybe they will tell you.

Laundry Equipment is what they call “Qualified Property,” which is old folk in Washington speak for something that lasts about 20 years or less. Laundry equipment qualifies, so you don’t need to worry. There are plenty of other things that qualify too, but we are in the laundry equipment business so freakin’ focus already. Oh and states are weird. For state taxes, ask a smarter human than me. In fact, run all this by your tax dude or dudette, before you go getting yourself all in trouble with the old folks.

Now you have been learned up about the bonus depreciation, let’s talk about your buddy and mine, Section 179. Before December 31,2017, you could expense $500K worth of eligible property in a year. The WHAMMO TAX ACT doubles that number. Now you can depreciate $1M in the first year! After that, you can use your bonus depreciation to go even deeper. Pretty slick, right?

Now you have all that stuck in your gourd, let’s add some more. By the end of this you are going to be either really smart or be the sufferer of a massive headache. Let’s find out which side you rock.

Before December 31, 2017, you could carry Net Operating Losses (your Monopoly Money Losses you claimed because of the depreciation you expensed is a bigger number than the number of dollars you made for real) for 20 years forward and 2 years backwards. The WHAMMO TAX ACT makes that forward action indefinite. The catch is…you can’t carry it back to get a bigger refund from last year. Now there are some things you need to read up, like interest expense limitations for people making more than $157K if filing by themselves or $315K filing jointly with their spouse. Details. Always details, but for most of us, this thing will be pretty straightforward.

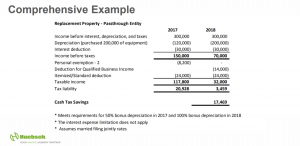

ANYHOO, let’s scope an example. I think it will make a lot more sense when we see this thing with numbers attached to it.

If you look at this little graphic, you will see the the difference in a store with $300K of revenue. Big deal. Lots of money saved on taxes. THANKS WHAMMO TAX ACT! Seriously. That is $17K in tax savings. Massive value there.

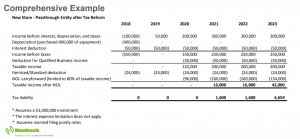

Now this graphic shows how you save in the long run. Or at least for the next six years, given your Net Operating Loss carry forward. Ain’t this some sweet, sweet savings?

Mind you, these charts assume you are filing jointly, and you aren’t super rich so the interest expense limitations don’t apply.

Bottom line is this right here. If you are thinking about getting into the laundry business, retooling your store, or buying some laundry equipment, now is the time to do it. The old farts in Washington are telling you to do it.

Call us today. We live for your questions. Not really, but you know. (615) 885-1115